Under the influence of COVID-19 's pandemic, China's industrial gas market performed poorly in the first half of the year. Although gas companies stepped up their efforts to improve their performance in the second quarter, according to the reports of various companies, the performance of some companies still declined compared with the same period last year.

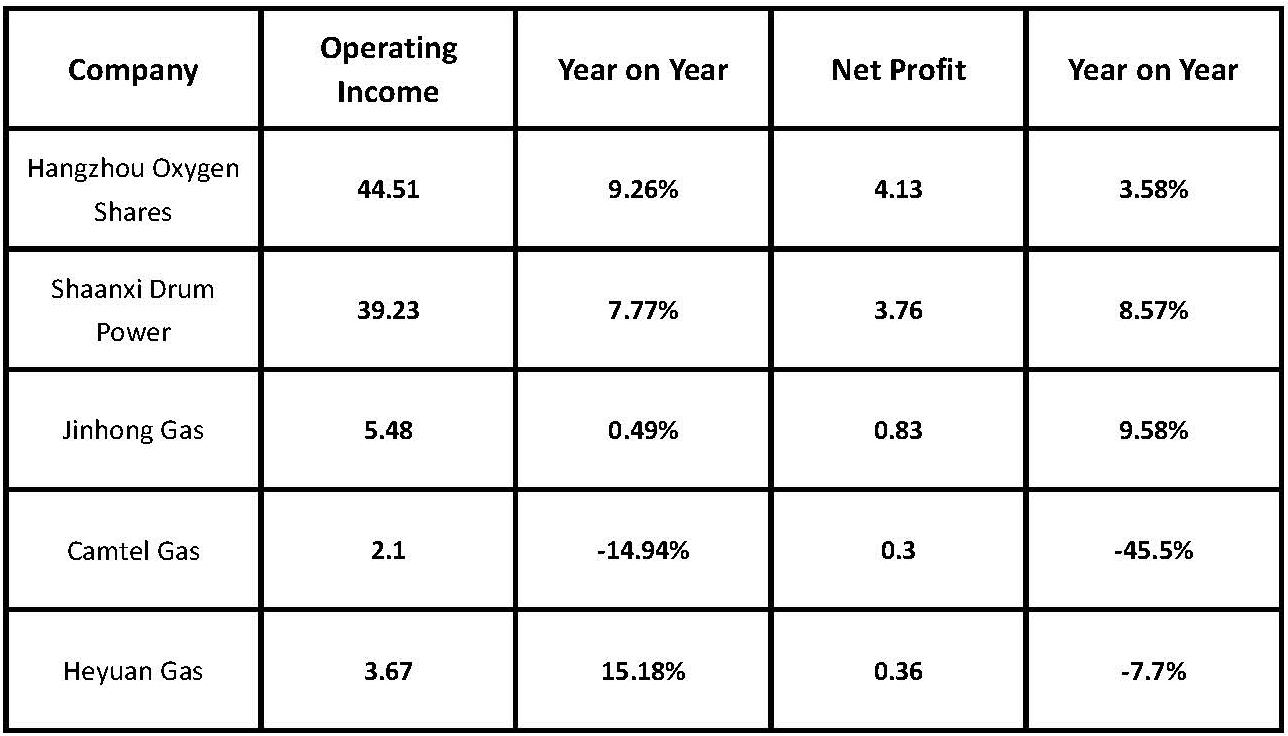

According to the performance disclosure of domestic listed gas companies, the performance of each company was different in the first half of the year, in which Hangzhou oxygen shares, Shaanxi Drum Power and Jinhong Gas all achieved double growth in revenue and net profit compared with the same period last year; Heyuan Gas's net profit decreased compared with the same period last year. Camtel Gas both declined.

Performance Chart of Major Chinese Gas Companies in the First Half of 2020

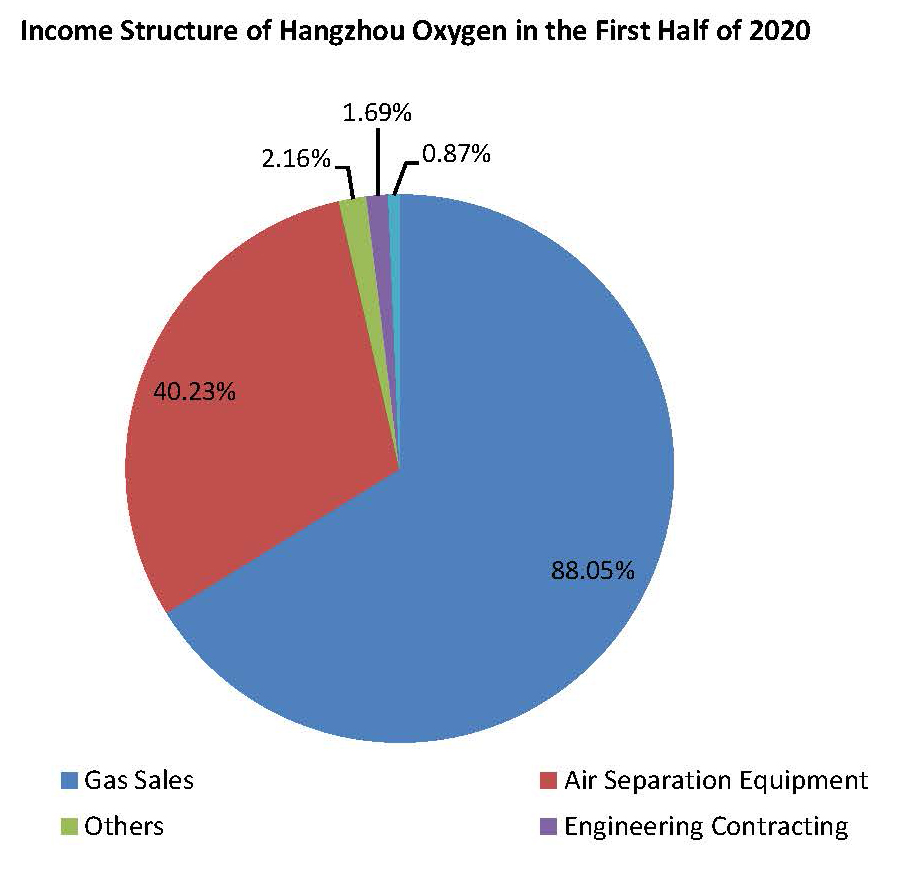

Although Hangzhou Oxygen was obviously affected by the pandemic in the first quarter, with the steady domestic pandemic and economic recovery in the second quarter, the Company increased its investment in business, which once reversed the passive situation of operation in the first quarter, making the company's operating income in the first half of the year at RMB4.451 billion, an increase of 9.26% over the same period last year, and the net profit of shareholders belonging to listed companies was RMB 413 million, an increase of 3.56% over the same period last year. In terms of products, its revenue from gas sales and air separation equipment is the highest, accounting for 55.05% and 40.23% of the total revenue respectively, both growing over the same period last year. In terms of equipment, a total of RMB3.312 billion was ordered for air separation equipment and petrochemical equipment, of which RMB 432 million was for petrochemical equipment, a record high for new contracts in recent years.

Shaanxi Drum Power's revenue and net profit in the first half of the year also achieved positive growth compared with the same period last year. The increase in revenue is mainly due to the increase in market capacity and orders due to the focus on the distributed energy market. In terms of new technology, Shaanxi Drum Power Company has completed the design of a 100,000-scale new air separation compressor with high pressure ratio axial flow new technology; completed the technical development of BPRT unit and some other technology combination optimization of high pressure ratio axial flow compressor used in metallurgical industry; in the field of new product development, the AV140-18 axial flow compressor rotor provided by the company has completed high-speed dynamic balance test at one time under the witness of users and design institutes. The company's AOD furnace steam and electric double drag dedusting fan unit, for the first time, combines the AOD furnace stainless steel smelting high temperature flue gas waste heat recovery generator set and the dedusting fan set into one, forming a brand-new combination of energy recovery and dedusting unit configuration in this field. In addition, further improvement has been made in the application of intelligent technology. Among them, the hydrogen bromide and carbonyl sulfur project in January passed the appraisal of new products and new technologies of the Department of Industry and Information Technology of Jiangsu Province.

Jinhong Gas performed well in the first half of the year, with revenue of 548 million yuan, basically the same as the same period last year. The net profit reached 83 million yuan, an increase of 9.58% over the same period last year. Although the epidemic situation has a certain impact on the company, it still continues to strengthen the research and development of new products, optimize product structure, actively open up the market, increase market share, and strengthen quality and internal control management.

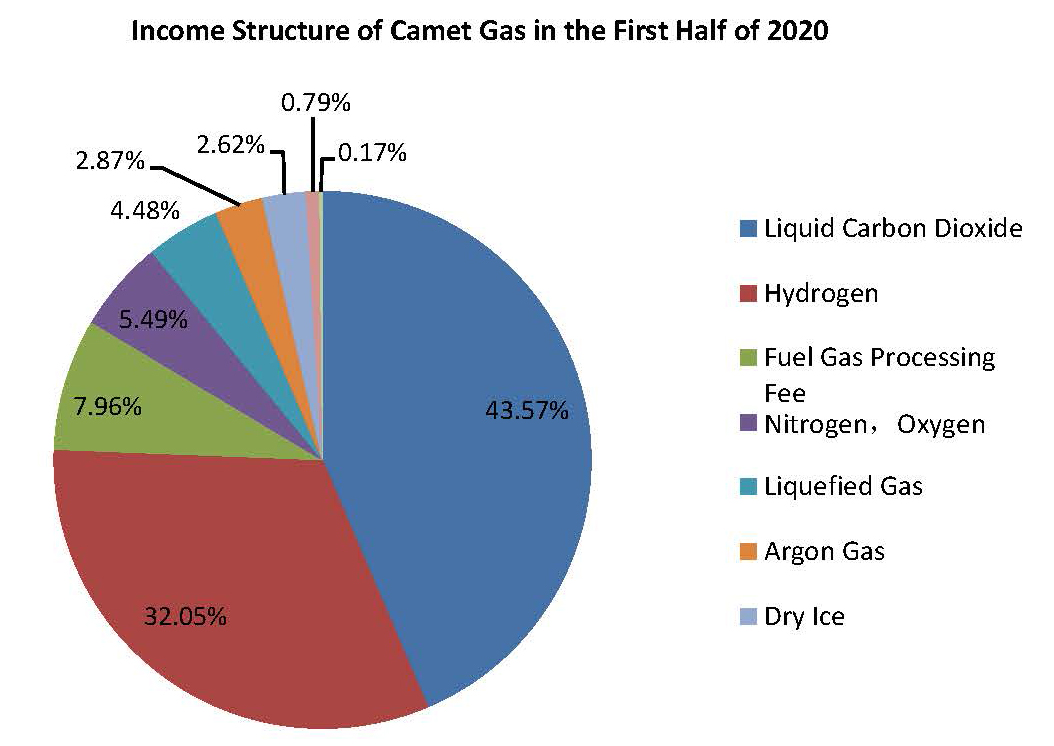

Camet Gas performed poorly in the first half of the year, with both revenue and net profit declining, mainly affected by the spread of the global pandemic and the huge drop in international oil prices. With the exception of Hainan Camet and Fujian Fuyuan Camet, the net profits of other companies are in a year-on-year decline. In terms of products, liquid carbon dioxide is still the main source of income, reaching RMB91.87 million in the first half of the year, accounting for 43.57% of the total income, followed by hydrogen reaching RMB67.56 million, accounting for 32.05%, the only product that achieved year-on-year revenue growth in the first half of the year.

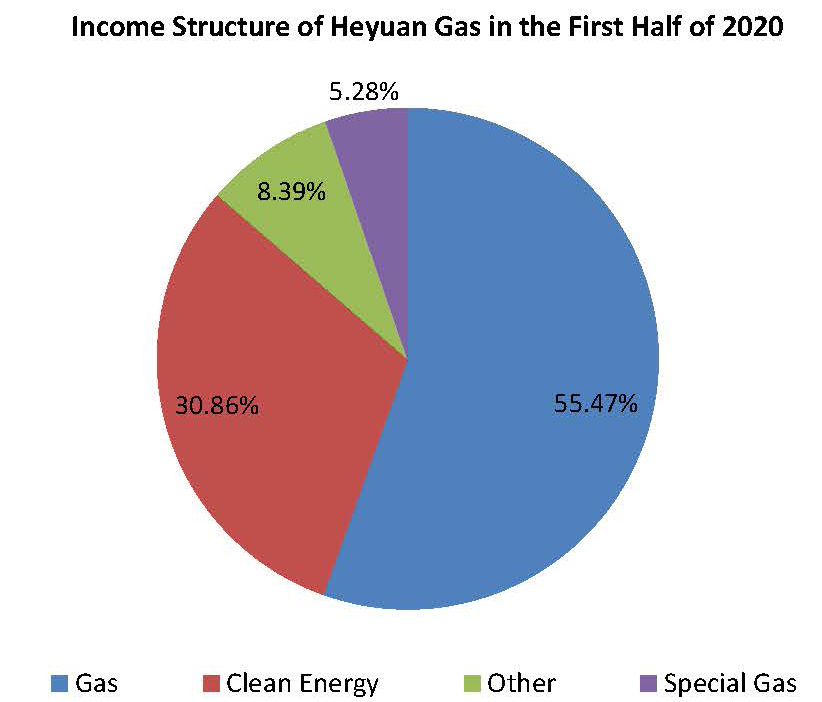

The performance of revenue and net profit of Heyuan Gas was different in the first half of the year, with revenue up 15.18% from the same period last year. This is mainly due to the increase in the company's liquid gas sales during the reporting period. It should be mentioned that Heyuan Gas as a national pandemic prevention materials key protection enterprises, the company does not hesitate to increase costs, adhere to not crazy price increases, do not stop gas supply because of slow customer repayment. At the same time, according to the actual situation of the company and external environmental factors to increase sales, expand regional market share. The decline in net profit resulted from the impact of the pandemic, changes in the market environment, fluctuations in the prices of liquid oxygen, liquid nitrogen and other products, while the proportion of clean energy sales with low gross profit margin has increased, resulting in a reduction in comprehensive gross profit margin.

In the second half of 2020, international environmental pressure is still spreading, but the domestic economic trend remains unchanged, and the manufacturing industry continues to heat up. In addition, considering that most gas companies have shown strong resilience in the first half of the year, their performance may be further improved in the second half of the year.

- Chinese refining companies show signs of recovery post COVID-19 impact, says GlobalData Jun 03,20 14:49

- China's Major Gases Listed Companies’ Report the Performance of Revenue and Net Profit Varies Nov 17,20 15:40

- Post Covid-19: China’s innovation development of hydrogen and fuel cell industry Jun 03,20 14:25

- China-Myanmar pipeline grows in its appeal Jun 03,20 14:54

- Guanggang Gas acquires Linde Wuhu Carbon Dioxide Company Mar 16,21 13:47